How FinTech Is Changing The Banking & Finance Sector?

Whether you realize it or no Fintech is likely a huge part of your life. Right from depositing a check by clicking a picture and depositing it to the bank account, to paying your bill at the restaurant by tapping your phone and heading back home in an Uber where you book a cab online and pay directly through the app.

According to the Global Fintech Adoption Index 2019, a study by Ernst & Young adoption of Fintech services has steadily moved up from 16 % in 2015 to 64 % in 2019, and the number has obviously grown in 2020 due to the pandemic and social distancing guidelines as a new norm. If you are still wondering what Fintech is, here is a brief understanding.

What is Fintech?

Financial Technology abbreviated as Fintech is an innovative technology that aims to transform the traditional way of dealing with finances with the help of improved financial services.

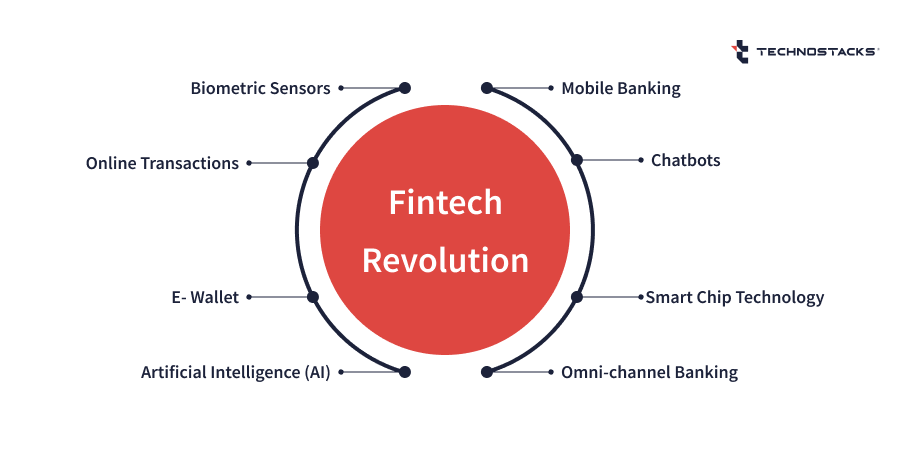

How FinTech Is Transforming The Banking & Finance Sector?

Smart Chip Technology

Smart Chip technology is basically the smart chip ATM card, which minimizes the financial impact due to mishaps. The EVM technology embedded in the chip works on a one-time password formula for each transaction, hence improves the security aspects as the code is valid only for one operation. In case your card is stolen, it will not be of any use to them.

On the other side, banks prefer their customers to memorize their pin and do not share it with anyone to avoid any mishaps. No wonder banks are working hard to match up to something which provides top-notch security to its customers.

Banks still use the magnetic stripe technology that requires the same pin for all the transactions, hence compromising the safety and making it susceptible to fraud.

Biometric Sensors

A biometric sensor is one of the inventions of Fintech. Biometric sensors and Iris scanners are the two technologies by Fintech which ATMs are using. These are advanced to a level whereas one need not carry a plastic card and need not require remembering the pin.

Also, these biometric-enabled ATMs use integrated mobile apps, fingerprint sensors, and eye and palm to identify the account owner. To make sure there is no kind of single mistake or error in customer recognition, ATMs also use micro-veins. Biometric technology gives a sigh of relief to those who get panic even with the thought of losing their ATM card. Biometric makes sure they can access their funds even after losing their card.

Online Transactions

The online transaction ensures an efficient electronic payment system. These electronic payments include payment of insurance premiums, social security, salary, payment of loans, bills, etc.

Omni-channel Banking

Fintech has made a considerable contribution to transforming traditional banking systems from one branch to various other digital channels, e.g., social, online, and mobile. This scenario eliminates the need to be dependent on banks and specific branches that offer certain functions. It results in banks adopting the omnichannel option and reducing their number of branches.

Chatbots for customer service

Chatbots have become popular when it comes to customer service; this machine learning-enabled bots efficiently streamlines client interactions by handling queries as humans and directing the query to the right department.

Many banks have made Chatbots an integral part of their process and programmed it to advise customers on investment plans or advise customers with the relevant information they are looking for, hence increasing overall customer satisfaction.

Artificial Intelligence (AI)

AI and Machine Learning make an excellent combination for detecting suspicious activities/ transactions. These AI-enabled fraud detection software generate an alert when they sense a potential fraud transaction, later the matter is handled for further investigation by humans.

With the technology becoming dynamic and scammers becoming smart, fraud detection is becoming difficult, putting customer data at risk. To address this issue, banks have adopted AI along with a machine learning-driven statistical model to leverage historical data to identify the pattern of fraud attacks. It also includes a data aggregation platform to track data and find out unstructured transactions. It further enables process automation to transform the AML operations, hence reducing the human effort to 50%.

E-Wallet

To name a few Samsung Pay, PayPal, Android Pay, and Apple Pay, some of the giants in the e-wallet world have widely used people to pay utility bills, booking tickets, paying on for purchases, and ordering food, etc.

Apart from these, many brands and e-commerce websites have come up with their own e-wallets, such as Starbucks/ Amazon/ Walmart Pay. These brands attract users by giving them an irresistible offer, cash backs, and reward points.

Banks have realized the potential in e-wallet due to its immense popularity and success. As a result, in collaboration with brands, many banks have come up with great e-wallet offers to lure customers.

Mobile Banking

The boost in the total number of smartphone users is spoiled with the choices they are offered at the convenience of their location with a few taps. This scenario has forced banks to offer mobile banking applications that provide convenient Fintech banking services.

As a result, nowadays, most banks have a mobile app that is user-friendly and has some fantastic features, like recognizing the user’s fingerprint. These apps work seamlessly without the need for any biometric app or hardware.

Mobile Apps have been everyone’s preferred choice for receiving and transferring funds and performing payment functions, right through the mobile banking app.

This scenario clearly shows that the role of Fintech in the banking industry is commendable, enabling banks to offer customer safe and user-friendly banking experience. Customers have embraced technology and demand more of it for smooth financial transactions, and the question still remains how are banks responding to Fintech?

Fintech simply uses an internet connection, mobile, and cloud to provide financial services. A few Fintech banking examples include:

-

- Mobile payment apps

Mobile wallets are the latest trend as people prefer to make payments without carrying cash/ card.

-

- Peer-to-peer payment apps

Apps such as Venmo, PayPal allows this feature.

-

- Blockchain and cryptocurrency

Bitcoins have been famous as an alternative to currencies.

-

- Mobile-Only banking

Mobile-only banks such as Ally and Marcus.

-

- Funding apps

Such as Ketto- allow individuals to raise funds from people rather than knocking investor’s doors.

-

- Peer to Peer loan programs

Websites or Apps that will enable people to get loans from friends or other individuals rather than from banks and traditional lenders.

-

- Insurance programs

Fintech makes it easy for people to get an insurance quote from various suppliers at once.

-

- Budgeting programs

These apps are directly connected to people’s bank accounts and credit cards to keep track of the income and spending.

The swift evolution of Fintech has transformed how financial institutions used to function – banks, insurers, and asset management companies have been facing a new reality.

Products and services that were used for decades can no longer be used in the digital world. To keep up with the growing or maturing demand of customers and trends, banks have reinvented their processes. Apart from banks, many tech giants, retailers, and global organizations are looking forward to solutions to provide financial services as per their customer’s demands.

Moving Forward

Fintech is not a rival for traditional financial institutions. In fact, Fintech in banking acts as a facilitator and not a competitor. It wants to work with banks hand-in-hand and grow as partners.

Banks and the credit unions and also the new Fintech providers are committed to providing a next-level banking experience. The advantages of Fintech in banking outweigh the challenges that face it. The partnership between banks and Fintech will create even better solutions and skills for the customers than the organization can offer on its own. Both the bank and Fintech together will surely create a new paradigm for every individual.

Technostacks is a leading FinTech app development company and if you want to develop a Fintech solution then you can contact us, email us on info@technostacks.com or call us on +919909012616. We will give you the best assistance for your app development.