The client needed a platform to connect micro-entrepreneurs and small informal businesses to micro-finance institutions & Banks to facilitate their access to funding. And also empower them with an intuitive as well as simplified dashboard to manage their operations.

Overview

The main objective of creating this fintech mobile application is to connect the micro-entrepreneurs and small informal businesses to micro-finance institutions & Banks for digital funding.

Client Requirement

Project Features and Functionalities

Product Recommendation for Funding

- An efficient, well designed, and real-time recommendation module that automatically uses machine learning models in the background to recommend products of MFI and NBFI for loan funding was enabled.

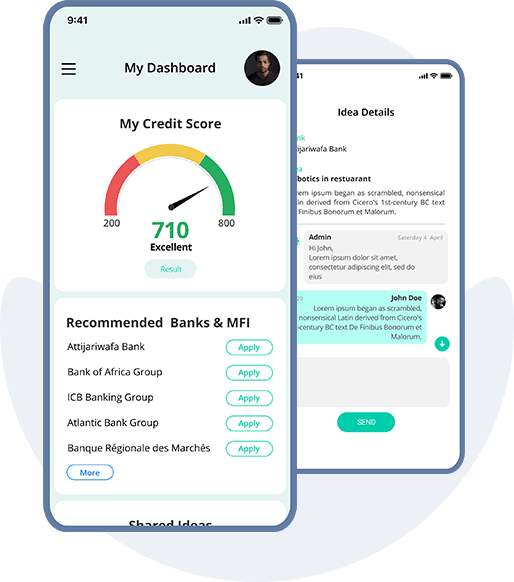

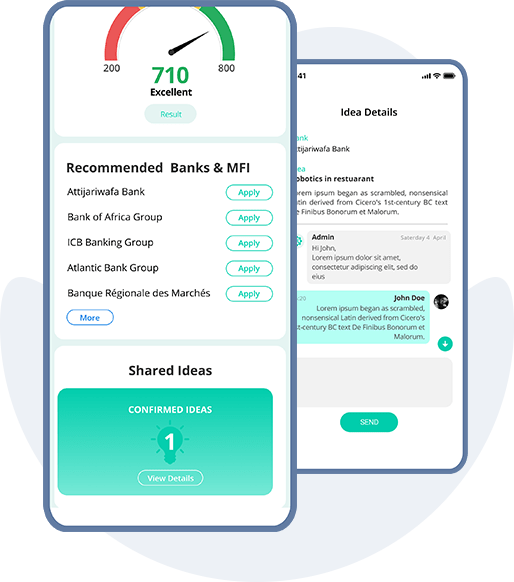

Real-Time Credit Score

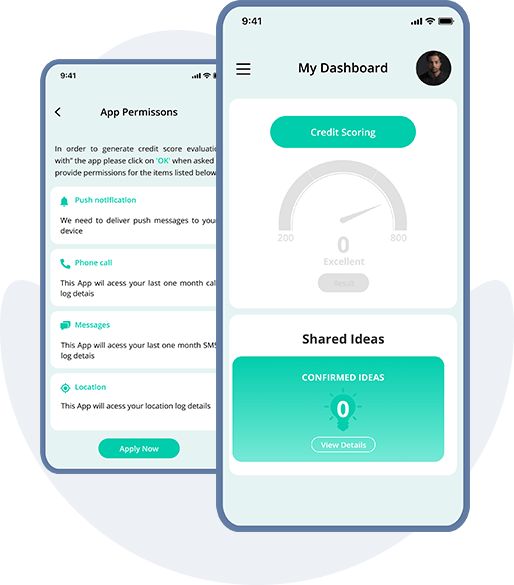

- An efficient, well designed, and real-time credit scoring module in mobile application using Machine learning platform to evaluate the creditworthiness of a micro-entrepreneur was facilitated based on call logs, SMS logs, discontinued geo-location logs, and psycho-technique test.

Easy Sharing Of Credit Score with MFI and NBFI

- A highly accessible, scalable, and secure infrastructure was enabled utilizing data streaming (Kafka) to ensure an adequate response time allowing micro-entrepreneurs to show and share credit scores with banks and MFI in seconds.

Real-time Chat Option

- FAT can chat with Micro-Entrepreneur, MFI, NBFI regarding the idea, shared profile and funding.

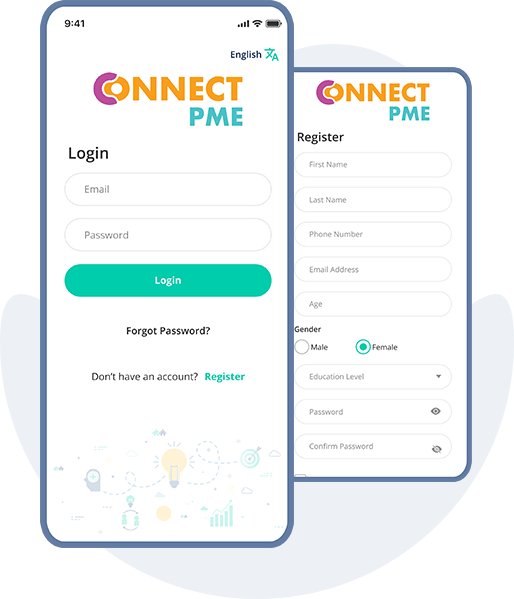

Digital Registration in Mobile Application by Face Recognition

- Easy digital registration in mobile applications with face recognition identifying the age of Micro entrepreneur was developed.

Reliable and Secure Platform

- Implementation of privacy and personal data protection, specifically, the platform is GDPR compliant was facilitated to safeguard intellectual property (IP) of micro-entrepreneurs’ ideas.

Features

Registration

As Micro-Entrepreneur, Finance Institution, and Non-Banking Finance Institution

Sign In As Entrepreneur with

- Dashboard access

- Chat access

- Credit score estimation

- Get notifications

- Change english language to the french language

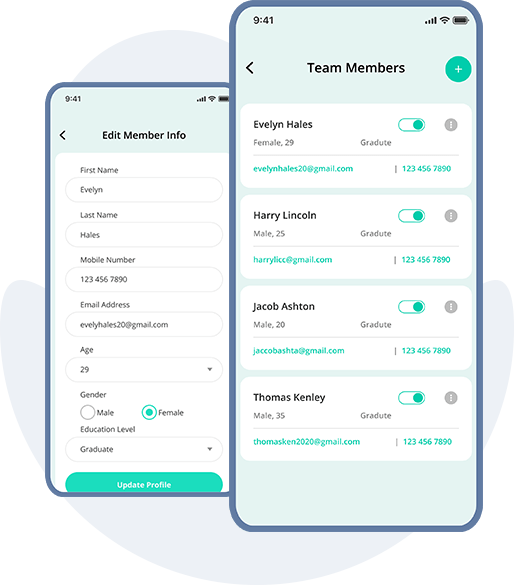

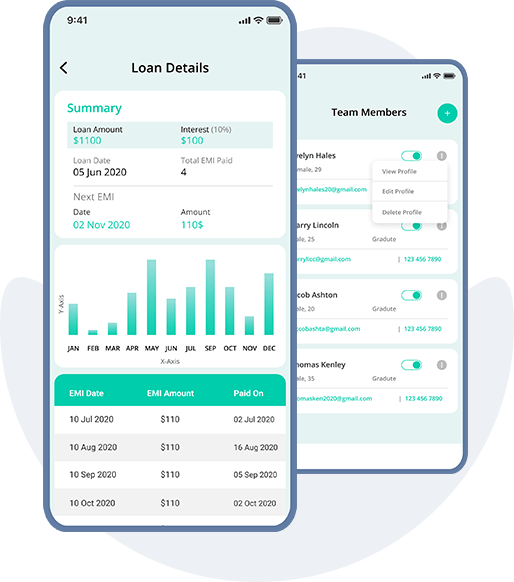

- Manage team

- Add new team member

- Edit or deactivate team member

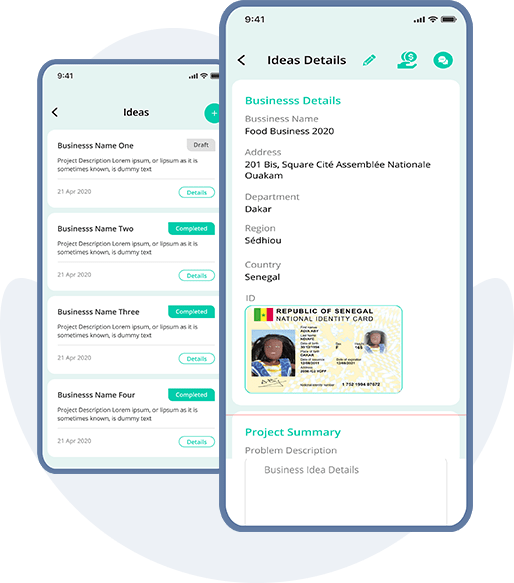

Business Idea

- Add a business idea as a business profile to get funding, with business ideas active once a time as approved, funded, deactivated and rejected.

Funding & Products

- Select products for funding business ideas.

Entrepreneur

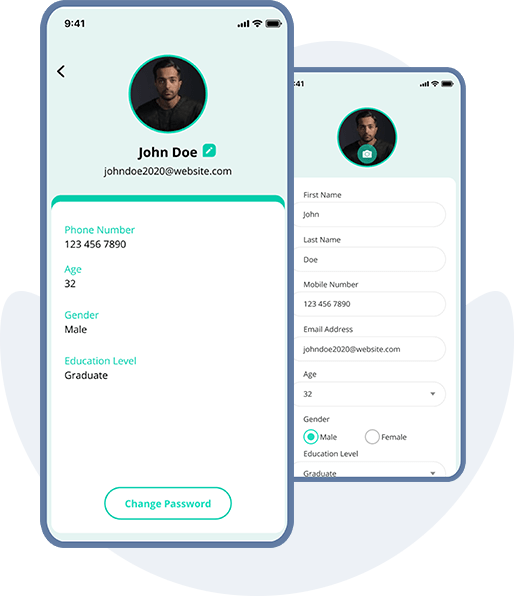

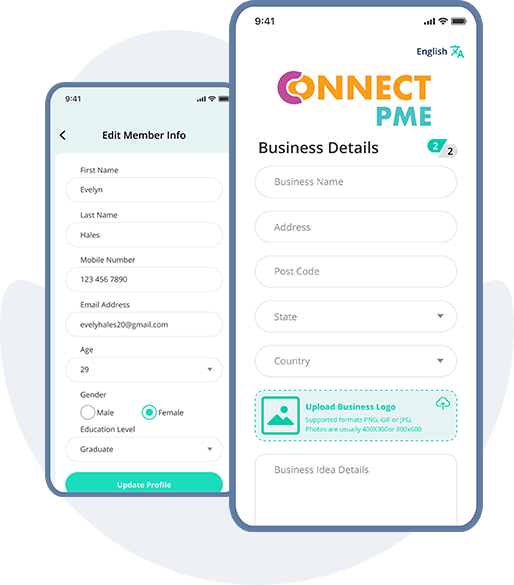

My Profile

- Edit profile for basic Info and changing the password.

Support

- Get support and redirect to text email.

Feedback

- Give star ratings.

Finance Institution

Dashboard

Showcase business profile idea status as approved or rejected for MFI.

- Get notifications

- Change english language to the french language

My Profile

- FI users can edit profiles for basic info and changing passwords.

Support

- Get support and redirect to text email.

Feedback

- Give star ratings.

Financial Products

- Display the fields.

Search for Financial Products

- Search and create new financial products.

Fund & Search Application

- New fund application listing

- Search new fund applications

Eye Icon

- Provide a detailed business profile. Institutions can accept and decline funding applications.

Accepted

- View accepted fund application listings.

Subscription Plan & History

- List the subscription plan details and history for FI subscriptions.

Non-Banking Finance Institution

Dashboard for NBFI Users

- Show business profile idea status as approved or rejected

- Get Notifications

- Change English Language to the French Language

- Managing Funding Criteria

FAT

- Manage Micro-Entrepreneurs, Financial Institution, and NBFI

- Search and review business profiles for approval and rejection

- List entrepreneur business ideas rejected by FI and NBFI

- Search and Reopen Business profile for Entrepreneur

- List entrepreneurs approved business ideas by FI and NBFI.

Eye Icon

- View business profile of Entrepreneurs with credit score.

Institution Subscriptions

- List all institution subscription plan details.

Status

- Filter subscription status for institutions by All, Active, Advanced and Expired

Institution Performance Statistics

- List statistics of business ideas accepted and declined by FI and NBFI on performance.

User Filter

- Offers results as Financial Institution or NBFI

Mobile Application Solution (Entrepreneur)

Include login, forgot password, change language, and registration details.

New Idea

- After registration entrepreneurs can share ideas for funding, new idea details are divided into three parts: Business Details, Project Summary, and Operation Budget.

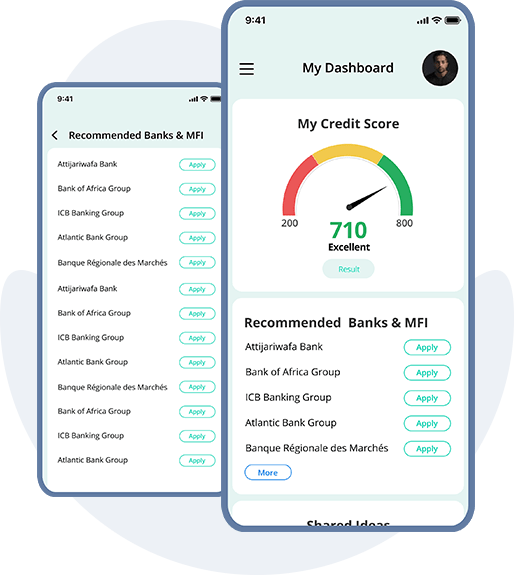

Dashboard

- Entrepreneurs can navigate to dashboard with Credit Score and Shared Idea.

Recommended Banks & MFI

- When credit score is generated, the Banks and MFI are recommended in listing. Entrepreneurs can apply for Recommended Banks and MFI for funding.

Shared Idea Status

- When an idea at registration is shared, it will have pending or confirmed status. If an applied Bank or MFI responds to an idea, status will change.

- Add New Team Member

- Change English Language to the French Language

- Users can set default language

Solution

Technostacks built an easy and user-friendly solution by providing a web panel for Micro-Entrepreneurs, MFI, NBFI & FAT, and also an Android Mobile Application for Micro-Entrepreneurs.

86.6%

Client Retention Rate

200+

Delivered Assets

6.4X

ROI of Re-Design

Our Solutions in Action

Read how we have transformed businesses along the way.

-

Industrial • Digital Products • Internet of Things (IoT): Achieving 50% Better Diagnostics and 30% Higher Productivity Through BLE Mobile Solutions

Achieving 50% Better Diagnostics and 30% Higher Productivity Through BLE Mobile Solutions

What if generator downtime could be reduced by 35%, servicing efficiency improved by 40%, and diagnostics accuracy increased by 50%, all through a single mobile app?

-

Industrial • Digital Products • Internet of Things (IoT): Enabling Smarter Industrial, Agricultural & Solar Operations through Long-Range, Low-Power IoT Monitoring with LoRa® Technology

Enabling Smarter Industrial, Agricultural & Solar Operations through Long-Range, Low-Power IoT Monitoring with LoRa® Technology

From noisy factories to sprawling farmlands and solar fields, reliable real-time monitoring was once a distant dream. Traditional wired and Wi-Fi systems failed to cover vast areas or withst…

-

Software & Platforms • Data & AI • Digital Products • Product Engineering: How a Jewellery Technology Pioneer Achieved 99% Accurate Diamond Testing with Technostacks AI-Powered Screening App

How a Jewellery Technology Pioneer Achieved 99% Accurate Diamond Testing with Technostacks AI-Powered Screening App

Clarity isn’t just for diamonds. With Technostacks AI-enabled mobile app, a jewellery technology innovator transformed diamond screening into a faster, more accurate, and fully automated e…

-

Industrial • Data & AI • Digital Products: AI-Enabled Zoho ERP Drives Cost Efficiency & Operational Visibility for Chemical Manufacturer

AI-Enabled Zoho ERP Drives Cost Efficiency & Operational Visibility for Chemical Manufacturer

Growth doesn’t have to wait. With Technostacks certified Zoho expertise, a global chemical leader turned years of ERP setbacks into measurable wins: faster deployment, lower costs, and AI-…

-

Healthcare • Cloud & DevOps • Digital Products • Strategic Consulting: Driving Affordable Access and Operational Efficiency in Medication Procurement

Driving Affordable Access and Operational Efficiency in Medication Procurement

Envision reducing prescription expenses by as much as 35%, enhancing patient medication adherence by 42%, and decreasing pharmacy operational inefficiencies by 50%, all facilitated through …

-

Healthcare • Internet of Things (IoT) • Product Engineering: Enhancing Hospital Hygiene and Reducing Infection Risks with Smart, Touchless UV Disinfection Technology

Enhancing Hospital Hygiene and Reducing Infection Risks with Smart, Touchless UV Disinfection Technology

Imagine reducing hospital-acquired infection risks, improving staff and patient confidence in sanitation, and enabling rapid hands-free disinfection in high-traffic medical environments—al…

-

Software & Platforms • Data & AI • Generative AI: Reduce Order Errors. Cut Manual Work. Serve More Customers Without Lifting a Finger

Reduce Order Errors. Cut Manual Work. Serve More Customers Without Lifting a Finger

Reduce human intervention in restaurant bookings by 90%, while giving every caller a smooth, intelligent ordering experience without hiring another soul.

-

Logistics • Data & AI • Generative AI: Automated Answers, Zero Wait Time – Reducing HR Load with a RAG-Based Fleet Chatbot

Automated Answers, Zero Wait Time – Reducing HR Load with a RAG-Based Fleet Chatbot

Turn hours of repetitive HR and ops support into a single chatbot, one that knows every fleet policy, SOP, and HR guideline your team could ask for. It works 24/7, never gets tired, and unde…

-

Logistics • Cloud & DevOps • Digital Products: Modernizing Balikbayan – Automating Last-Mile Delivery for Faster, Smarter Shipping

Modernizing Balikbayan – Automating Last-Mile Delivery for Faster, Smarter Shipping

Sending a Balikbayan box from Sydney to Manila can be seamless, tracked from the moment it’s picked up at your doorstep to the second it reaches your loved one’s hands, all without the h…

Lets Talk

Have a challenge?Let us know.