The client needed a platform to connect micro-entrepreneurs and small informal businesses to micro-finance institutions & Banks to facilitate their access to funding. And also empower them with an intuitive as well as simplified dashboard to manage their operations.

Client Requirement

PROJECT FEATURES AND FUNCTIONALITIES

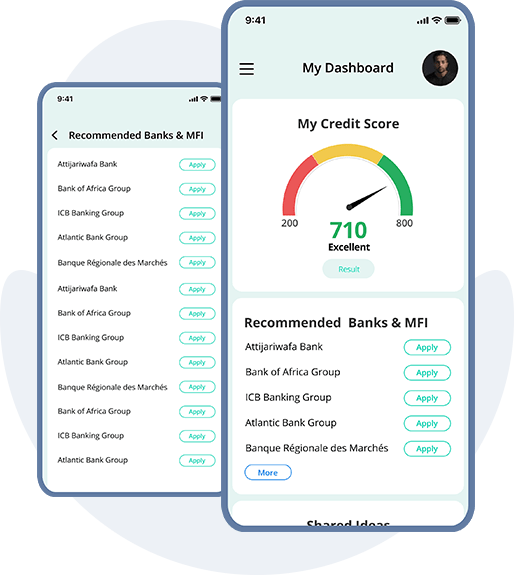

Product Recommendation for Funding

An efficient, well designed, and real-time recommendation module that automatically uses machine learning models in the background to recommend products of MFI and NBFI for loan funding was enabled.

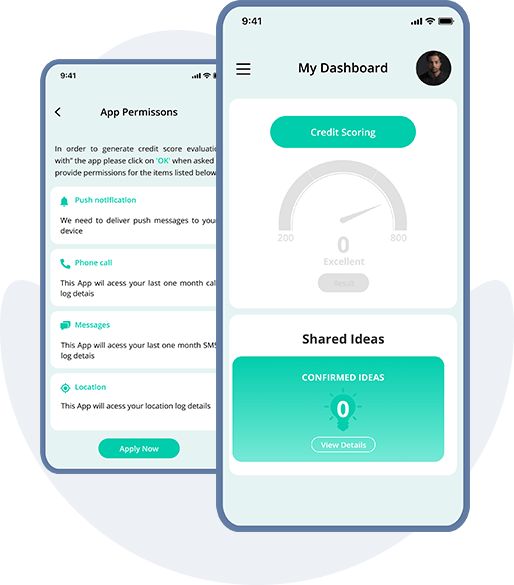

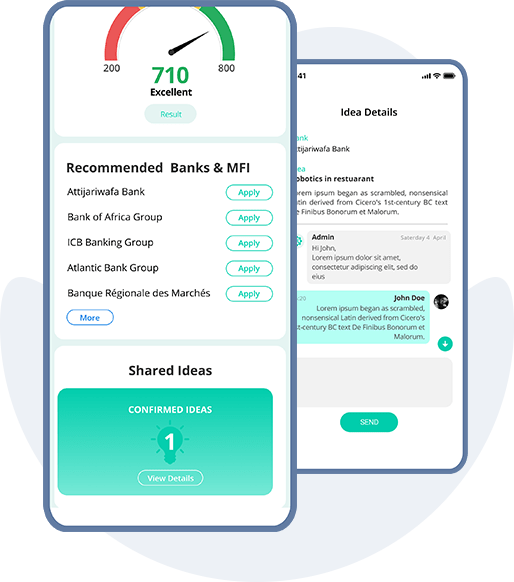

Real-Time Credit Score

An efficient, well designed, and real-time credit scoring module in mobile application using Machine learning platform to evaluate the creditworthiness of a micro-entrepreneur was facilitated based on call logs, SMS logs, discontinued geo-location logs, and psycho-technique test.

Easy Sharing Of Credit Score with MFI and NBFI

A highly accessible, scalable, and secure infrastructure was enabled utilizing data streaming (Kafka) to ensure an adequate response time allowing micro-entrepreneurs to show and share credit scores with banks and MFI in seconds.

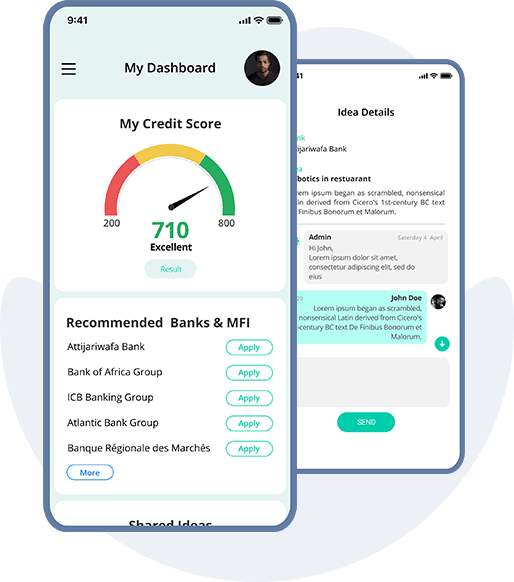

Real-time Chat Option

FAT can chat with Micro-Entrepreneur, MFI, NBFI regarding the idea, shared profile and funding.

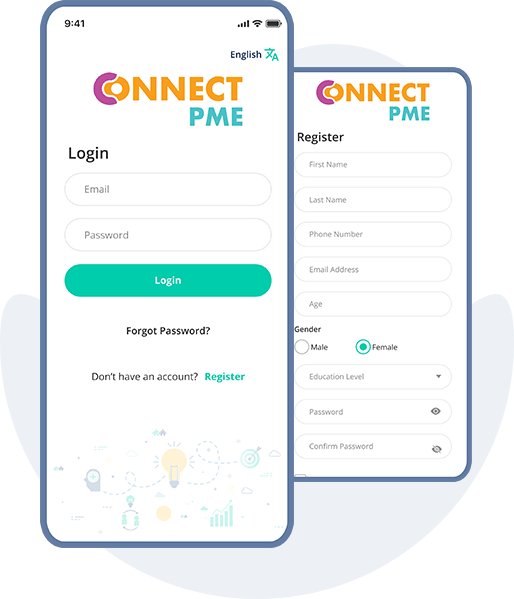

Digital Registration in Mobile Application by Face Recognition

Easy digital registration in mobile applications with face recognition identifying the age of Micro entrepreneur was developed.

Reliable and Secure Platform

Implementation of privacy and personal data protection, specifically, the platform is GDPR compliant was facilitated to safeguard intellectual property (IP) of micro-entrepreneurs’ ideas.

Features

Registration

As Micro-Entrepreneur, Finance Institution, and Non-Banking Finance Institution

Sign In As Entrepreneur with

- Dashboard access

- Chat access

- Credit score estimation

- Get notifications

- Change english language to the french language

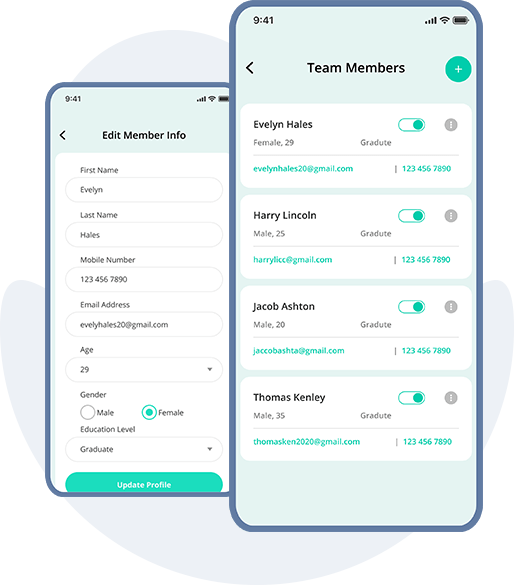

- Manage team

- Add new team member

- Edit or deactivate team member

Business Idea

Add a business idea as a business profile to get funding, with business ideas active once a time as approved, funded, deactivated and rejected.

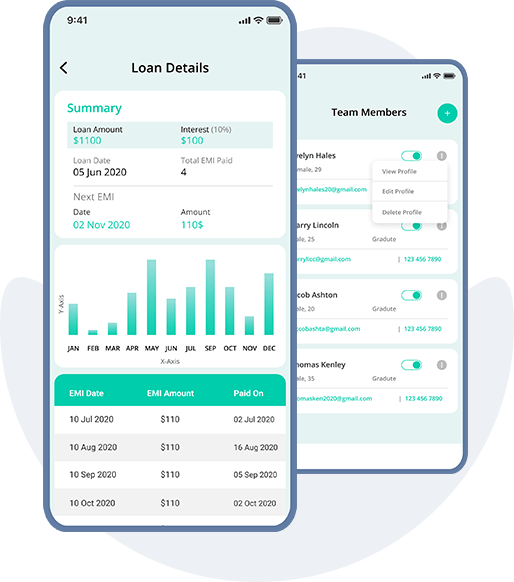

Funding & Products

Select products for funding business ideas.

ENTREPRENEUR

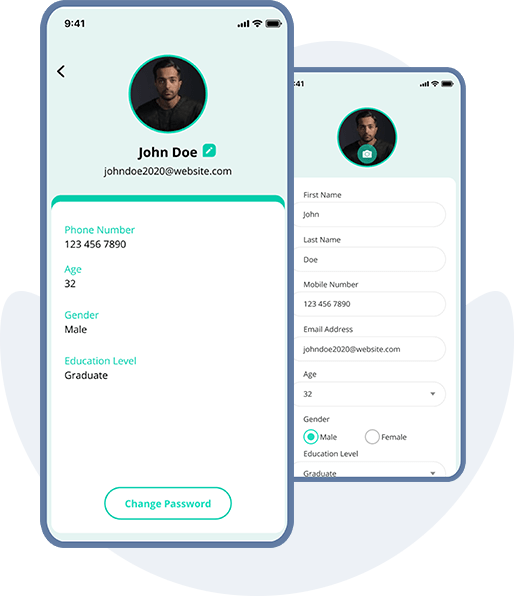

My Profile

Edit profile for basic Info and changing the password.

Support

Get support and redirect to text email.

Feedback

Give star ratings.

FINANCE INSTITUTION

Dashboard

Showcase business profile idea status as approved or rejected for MFI.

- Get notifications

- Change english language to the french language

My Profile

FI users can edit profiles for basic info and changing passwords.

Support

Get support and redirect to text email.

Feedback

Give star ratings.

Financial Products

Display the fields.

Search for Financial Products

Search and create new financial products.

Fund & Search Application

- New fund application listing

- Search new fund applications

Eye Icon

Provide a detailed business profile. Institutions can accept and decline funding applications.

Accepted

View accepted fund application listings.

Subscription Plan & History

List the subscription plan details and history for FI subscriptions.

NON-BANKING FINANCE INSTITUTION

Dashboard for NBFI Users

- Show business profile idea status as approved or rejected

- Get Notifications

- Change English Language to the French Language

- Managing Funding Criteria

FAT

- Manage Micro-Entrepreneurs, Financial Institution, and NBFI

- Search and review business profiles for approval and rejection

- List entrepreneur business ideas rejected by FI and NBFI

- Search and Reopen Business profile for Entrepreneur

- List entrepreneurs approved business ideas by FI and NBFI.

Eye Icon

View business profile of Entrepreneurs with credit score.

INSTITUTION SUBSCRIPTIONS

List all institution subscription plan details.

STATUS

Filter subscription status for institutions by All, Active, Advanced and Expired

INSTITUTION PERFORMANCE STATISTICS

List statistics of business ideas accepted and declined by FI and NBFI on performance.

USER FILTER

Offers results as Financial Institution or NBFI

MOBILE APPLICATION SOLUTION (ENTREPRENEUR)

Include login, forgot password, change language, and registration details.

NEW IDEA

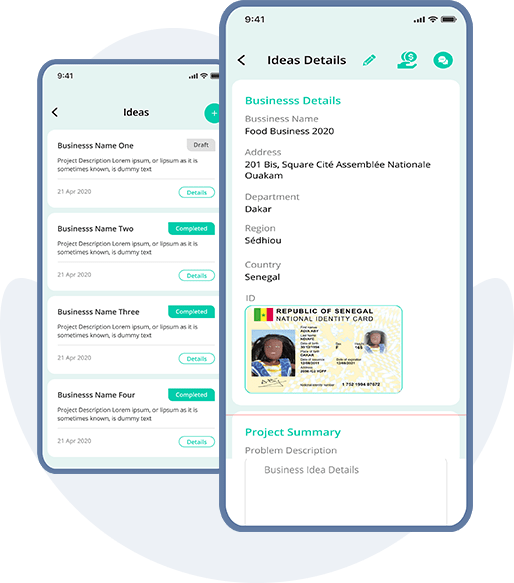

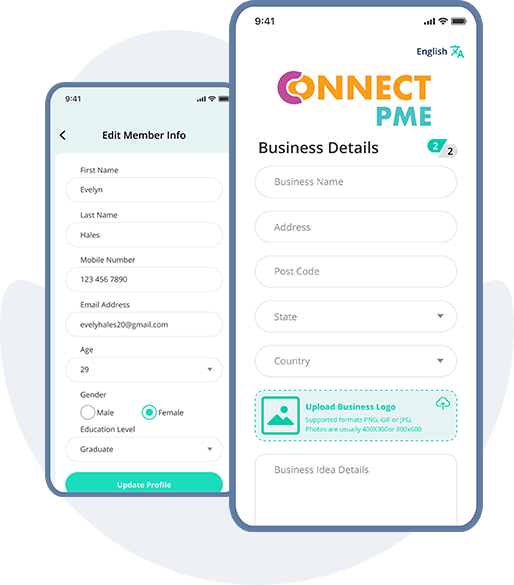

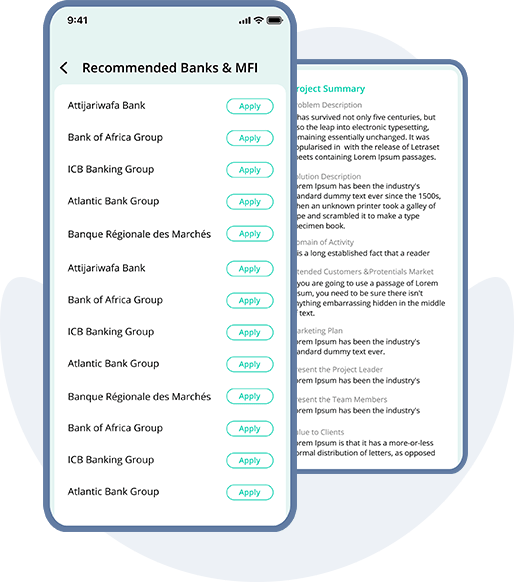

After registration entrepreneurs can share ideas for funding, new idea details are divided into three parts: Business Details, Project Summary, and Operation Budget.

DASHBOARD

Entrepreneurs can navigate to dashboard with Credit Score and Shared Idea.

RECOMMENDED BANKS & MFI

When credit score is generated, the Banks and MFI are recommended in listing. Entrepreneurs can apply for Recommended Banks and MFI for funding.

SHARED IDEA STATUS

When an idea at registration is shared, it will have pending or confirmed status. If an applied Bank or MFI responds to an idea, status will change.

- Add New Team Member

- Change English Language to the French Language

- Users can set default language

Solution

Technostacks built an easy and user-friendly solution by providing a web panel for Micro-Entrepreneurs, MFI, NBFI & FAT, and also an Android Mobile Application for Micro-Entrepreneurs.

Technologies Used